Financial Information Needed For Your Loan Request

A quick guide to types of documentation needed with a loan request.

It’s the age-old question – what documentation do I need to provide with my loan request? This quick guide will help you figure out what documents you need to provide and why.

1. Financial Statement

A financial statement (also known as a balance sheet) is a quick reference to let us know where you stand with your assets (what you own) and your liabilities (what you owe). It helps us as lenders see if you’ve built up some personal equity. What is equity? According to Webster’s Dictionary, it is, “the money value of a property or of an interest in a property in excess of claims or liens against it.” This helps us gauge if you owe more than what you own.

2. Drivers License (for all applicants)

Why your drivers license? This helps us know we have your name legally correct in our system and if the address is different than what you’ve reported on your application we can document why.

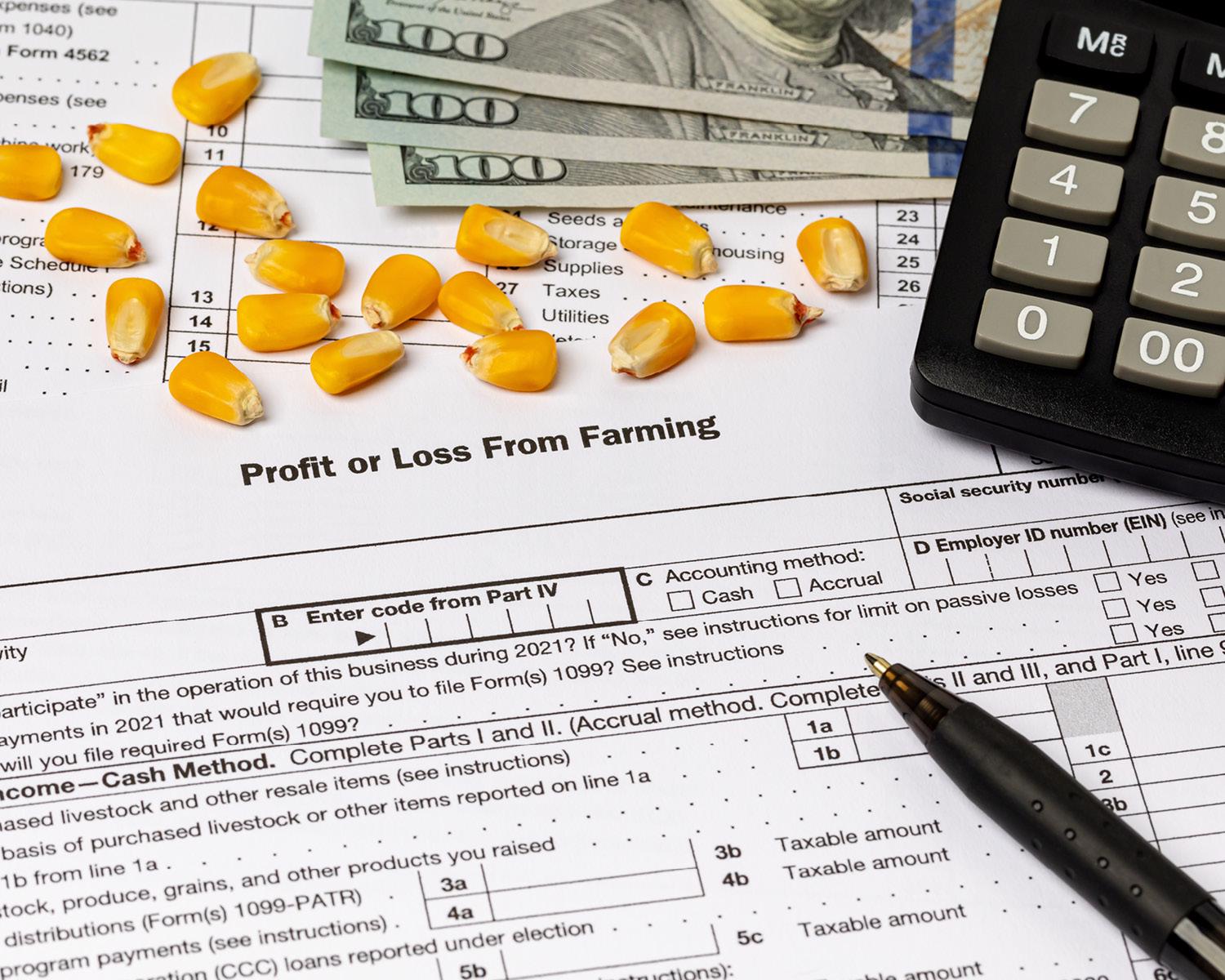

3. Three Years of Federal and State Tax Returns

Why so many years of tax returns? On many loans we like to be able to use a 3-year average of income, especially for those that are self-employed. For our wage-earners, we like to see the consistency of your income and if the amount has changed over the years (up or down) we can document the reason. For our self-employed customers or full-time farmers, it helps us to see how consistent your income has been. Also, if there are any large depreciation expenses we can document why and see if we need to project those going forward. We do our best to project your income going forward, but that depends heavily on the documents you provide.

4. Paystubs and Bank Statements

We ask for 30 days of paystubs to show you currently hold the job that you stated your income is derived from. We ask for three months of bank statements to show consistency of your income (deposits) and to allow for any payments to be viewed in case your credit report doesn’t show it. It also allows us to verify the amount in your bank account you have reported to us during the application process.

5. Most Recent 401k or Retirement Account Statement

These statements verify the amount of retirement or 401k you’ve reported to us during the application process.

6. Legal Description, Real Estate Contract, and Survey

The legal description is the precise location and measurement of real property. This gives us an accurate description of the land you’re going to purchase or refinance. We submit this information to the appraiser and title companies to make sure we’re all on the same page as far as the property we’re looking at & to make sure it all flows property and there are no discrepancies with the property boundaries and easements. We want to make sure the property you want to buy or refinance is truly the property you have in mind!

If you have any questions about the loan application process, reach out to your nearest branch.

Other News