What Home Can I Afford?

Dilynn Dodd, Vice President and Loan Officer, Consumer Lending, offers insight on securing your dream home within budget.

Many of you may be in the market to purchase a home, or you might be considering it in the near future. Whether this is your first home purchase or you are a seasoned homeowner, your first thought might be “What home can I afford?” This is a common and important question that buyers ask themselves when starting to look at property. It is also something your financial institution will consider. There are several factors that a lender will take into account when pre-approving a future homebuyer for a loan. Here are six factors that will assist you in determining what you can afford before you pick out your perfect future home.

Down Payment

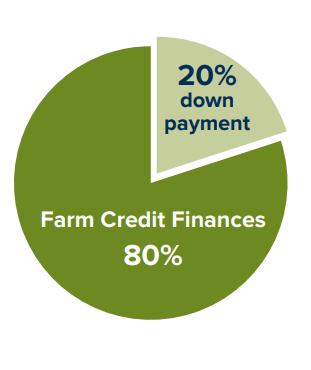

A down payment is a percentage of your home’s purchase price that you pay when you close your loan. This is often looked at as your investment in the house. The down payment for a loan is generally in the form of cash, however, down payment can come in other forms that you can discuss with your lender. Some examples of other down payment options could be other land equity, another loan, or gift money. You never want your down payment to completely liquidate you and empty out your checking or savings account.

A general rule of thumb is to have at least 20% of the purchase price for your down payment. For example, if you are buying a house for $300,000, you will need $60,000 for down payment and Farm Credit will finance $240,000 towards the purchase.

LTV

Loan-to-Value (LTV) is the ratio of your loan amount versus the collateral value of the house, land, and other structures that hold value on the property. Collateral value is the purchase price or the appraised value, whichever is least. In this calculation, paper equity is not considered part of your collateral. Paper equity occurs when the value of the home is greater than the purchase price.

Loan amount ÷ appraised value or purchase price (whichever is least) = loan-to-value (LTV)

PITI

PITI is an acronym for Principal, Interest, Taxes, and Insurance. This will be your monthly mortgage payment (principal and interest) plus your estimated monthly real estate taxes and homeowners’ insurance all added together. Even though Farm Credit of Western Arkansas does not escrow real estate taxes and homeowners’ insurance (unless the property is in a flood zone), we still look at the total PITI calculation. The general rule is for PITI to be equal to or less than 28% of gross monthly income.

Monthly income × 28% = monthly PITI

DTI

Debt-to-Income (DTI) is a common ratio homebuyers will hear lenders use. For a W2 wage earner, this is calculated by analyzing all your monthly debt payments, including your PITI, into your gross income. Monthly debt payments are anything that you make a regular monthly payment on outside of your living expenses. For example: vehicles, credit cards, student loans, child support, etc. Preferred DTI ratio is 36% or lower.

(PITI + Other Monthly Debt Payments) ÷ Monthly Gross Income = DTI

Credit

To secure a home mortgage, you want to have established credit. Generally, the minimum credit score needed for a home mortgage is around 650 or higher. The higher the credit score, the better rate you will get on your mortgage. Credit scores are determined using five distinct factors – payment history, the amount of debt owed, length of credit history, new or recent credit and the types of credit used. Want to learn more about credit scores? Check out our blog about understanding your credit score.

Other Expenses

When buying a new home, there are always unexpected expenses that come up outside of the loan and closing fees. Those expenses can range from deposits needed to get utilities transferred to the buyer, repairs or maintenance needed, or moving service fees. This is why Farm Credit will not allow you to completely liquidate your checking and savings accounts for the down payment on the purchase.

What Can They Afford?

Josh and Sarah’s gross income is $75,000 a year. With at least 20% down payment, they could potentially afford a home in a range of $200,000 to $250,000, depending on their other monthly debt payments and their loan interest rate.

Purchase price: $230,000

Down payment calculation: $230,000 x 20% = 46,000

Loan amount: Purchase price – down payment = $184,000

PITI calculation: $75,000 gross yearly income / 12 months = $6250 gross monthly income

Gross Monthly Income x 28% = $1750

The couple’s monthly principal, interest, taxes, and insurance payment should not exceed $1750. Before Josh and Sarah pick out their perfect home, they also need to consider their estimated cost of taxes and insurance, monthly debt payments, and other factors listed above.

(Note: Lenders consider multiple factors and each individual situation when determining eligibility for home loans. The above example is fictitious and for illustrative purposes only.)

Are you ready to start shopping for your next home? Our team of home lending experts is ready to help. Find a branch near you to get started.

Other News